[Webinar] What are the most impactful and sought-after use cases for Agentic AI in banking and insurance operations?

![[Webinar] What are the most impactful and sought-after use cases for Agentic AI in banking and insurance operations?](https://www.zelros.com/wp-content/uploads/2025/06/July-31st-webinar-770x510.webp)

Replay available!

The focus has recently shifted naturally from the foundational understanding of Agentic AI to its practical applications and the tangible value that it can deliver. This reflects the industry’s recognition of Agentic AI’s transformative potential, coupled with legitimate concerns about implementation challenges, regulatory compliance, and risk management.

For banking and insurance organizations, the core questions revolve around identifying high-impact use cases and understanding the expected benefits in terms of operational efficiency, cost savings, enhanced customer experience, risk mitigation, and innovation.

This July, we proposed three specific use cases for banking and insurance operations and asked our audience which use case they would like to focus on for thirty minutes.

Use case 1: How does agentic AI ensure continuous KYC compliance, enhance efficiency and accuracy, and adapt to evolving regulations?

✅ Stay compliant by efficiently capturing mandatory data that aligned with the current and upcoming regulations.

✅ Stay informed with the upcoming changes on new regulations

✅ Inform producers and advisors about any incoherent data in the current database to prevent negligence, fraud and bad risk assessment.

Use case 2: How Does Agentic AI Improve Customer Engagement and Personalization?

The goal is to equip producers with hyper-personalized recommendations at scale and in real-time, supporting agents with dynamic, compliant, and distinct talking points.

See how our Magic Recommendation and pre-packaged features enable you to ask the right questions at the right time, maximizing each interaction to:

✅ Enhance agents & advisors recommendations

✅ Ensuring compliance with insurance & banking advisory duties

✅ Strengthen employees’ pitch, launch promotions for new products, adopt new risk assessment rules, and update marketing and digital campaigns systematically

Use case 3: Can AI Agents actually help with complex policy documents from bank and insurance? And how exactly?

The goal is to equip producers with a tool that allows them to cut down time from hours to minutes, and leave space to focus on provide better customer experience We want to validate the need for specialized solutions tailored to insurance documentation, as this is essentially a “magic answer” engine built for a highly regulated, complex document set.

Leveraging third-party data, expert insights from Zelros, and your own structured and unstructured data, the answers are generated using several sources to ensure accuracy and relevance.

✅ Contextualized responses to clients' and/or employees' requests

✅ High-quality, accurate responses without hallucinations, with easily accessible sources

✅ Continuous improvement through feedback loops

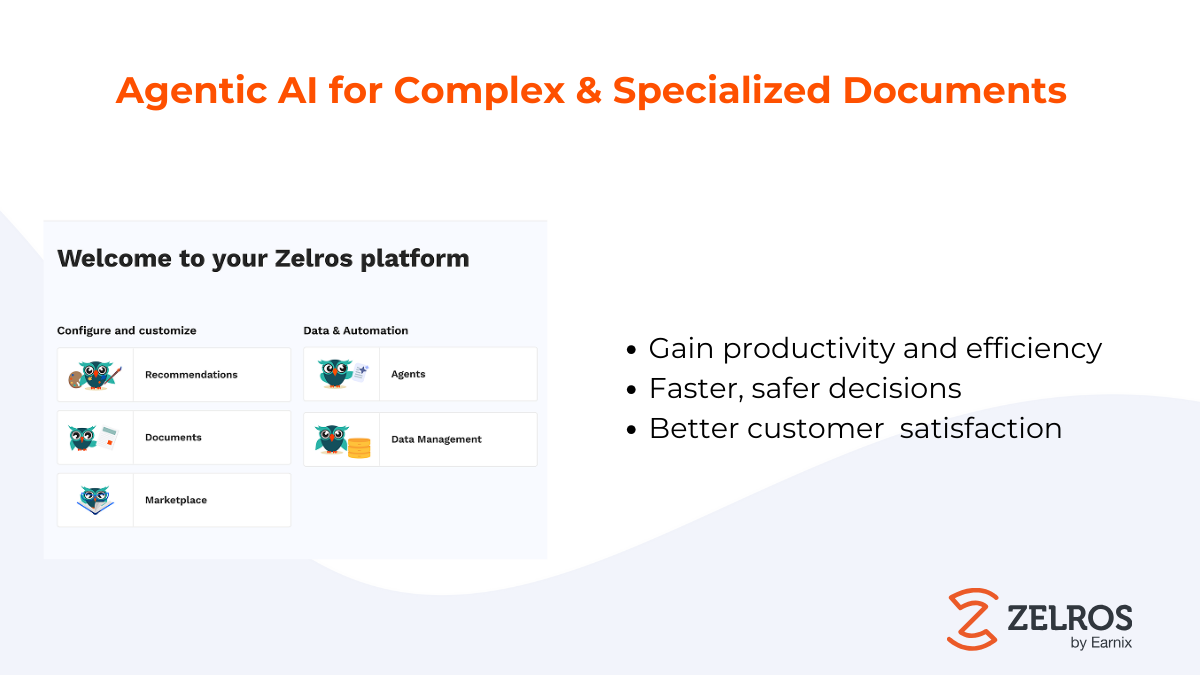

The most popular use case identified was the use of AI Agents for complex and specialized documents. During a 30-minute presentation, we showcased three different examples:

- How AI Agents can assist insurance producers in quickly finding information while they are on calls with clients.

- How policyholders can engage with their contracts to receive responses that are accurately sourced directly from those documents.

- How to utilize Agentic AI to automate tasks, such as claims approval.

The replay is now available and can be directly viewed after submitting the form on this page. Don’t hesitate to reach out to us if you have any questions.